When Are Property Taxes Due In Illinois 2025

When Are Property Taxes Due In Illinois 2025. Under state law changes, in place through tax year 2025, the maximum amount of property taxes that can be deferred annually has been temporarily increased. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and.

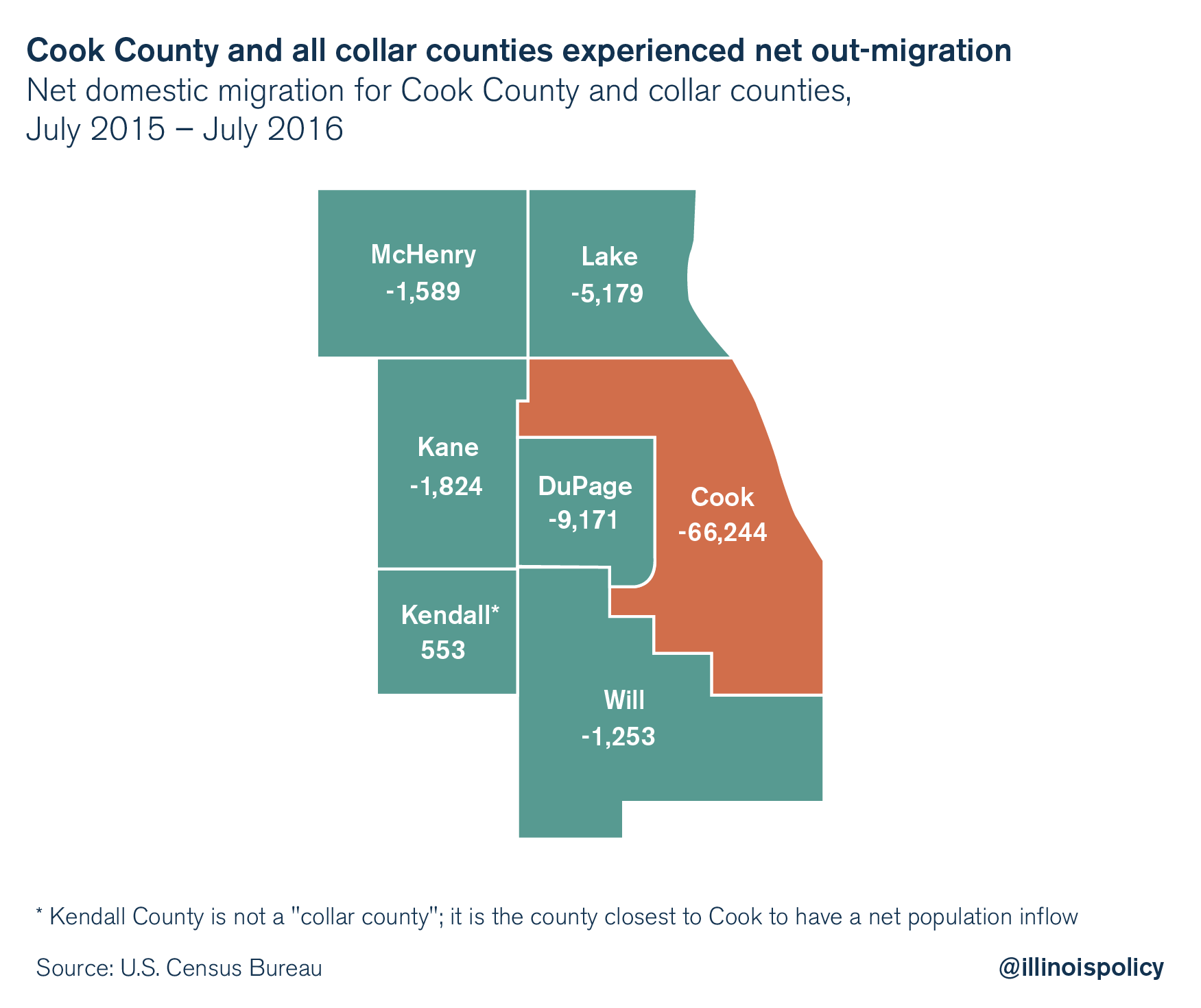

Cook county property tax officials announced today that second installment property tax bills for tax year 2023 will be available to property owners by july 2, 2024. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free illinois property tax estimator tool to.

See How Your Tax Bill Changed.

Your email will never be sold or used by any office other than the kankakee county treasurer

While The Exact Property Tax Rate You Will Pay Will Vary By County And Is Set By The Local Property Tax Assessor, You Can Use The Free Illinois Property Tax Estimator Tool To.

Under state law changes, in place through tax year 2025, the maximum amount of property taxes that can be deferred annually has been temporarily increased.

When Are Property Taxes Due In Illinois 2025 Images References :

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

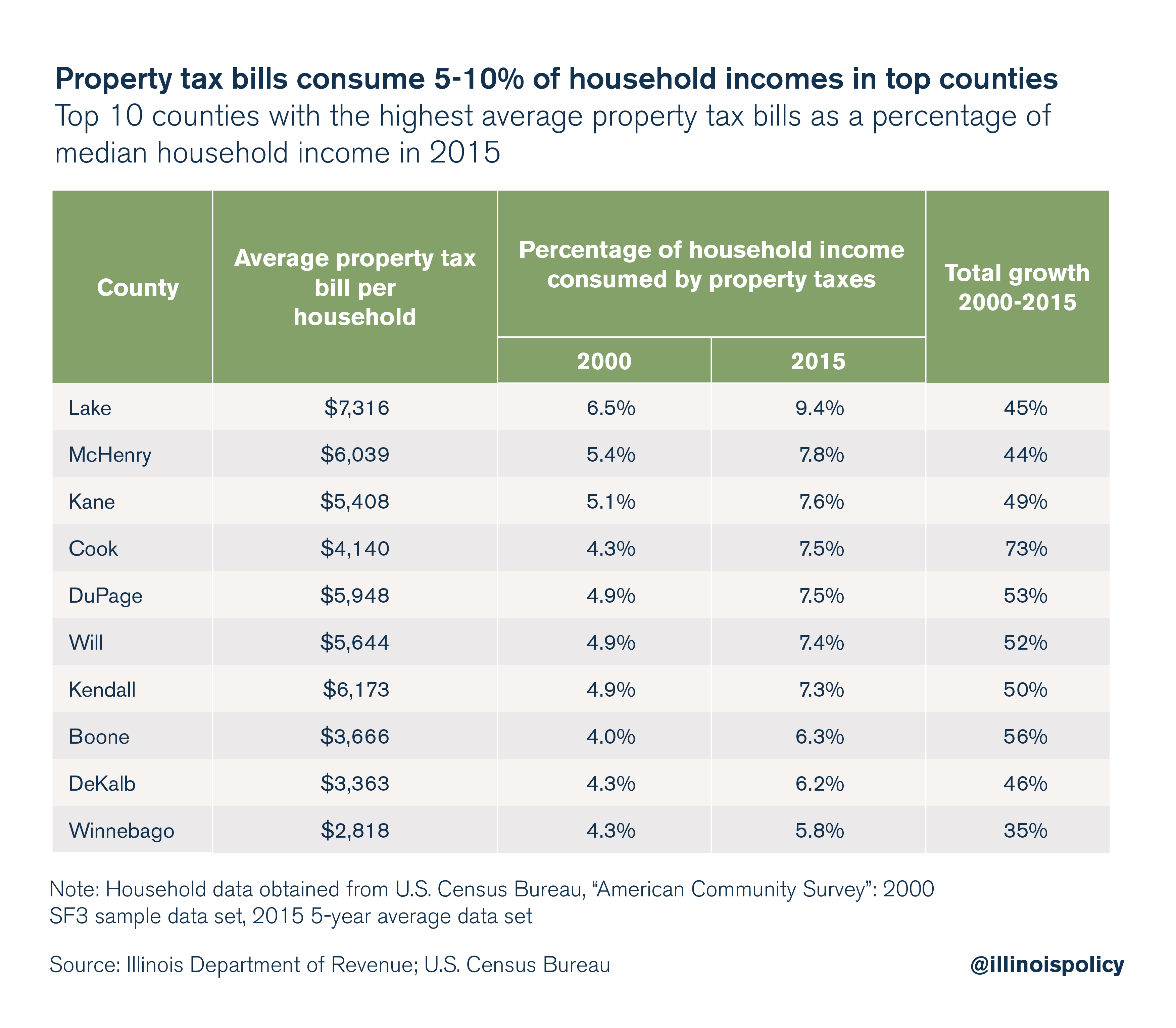

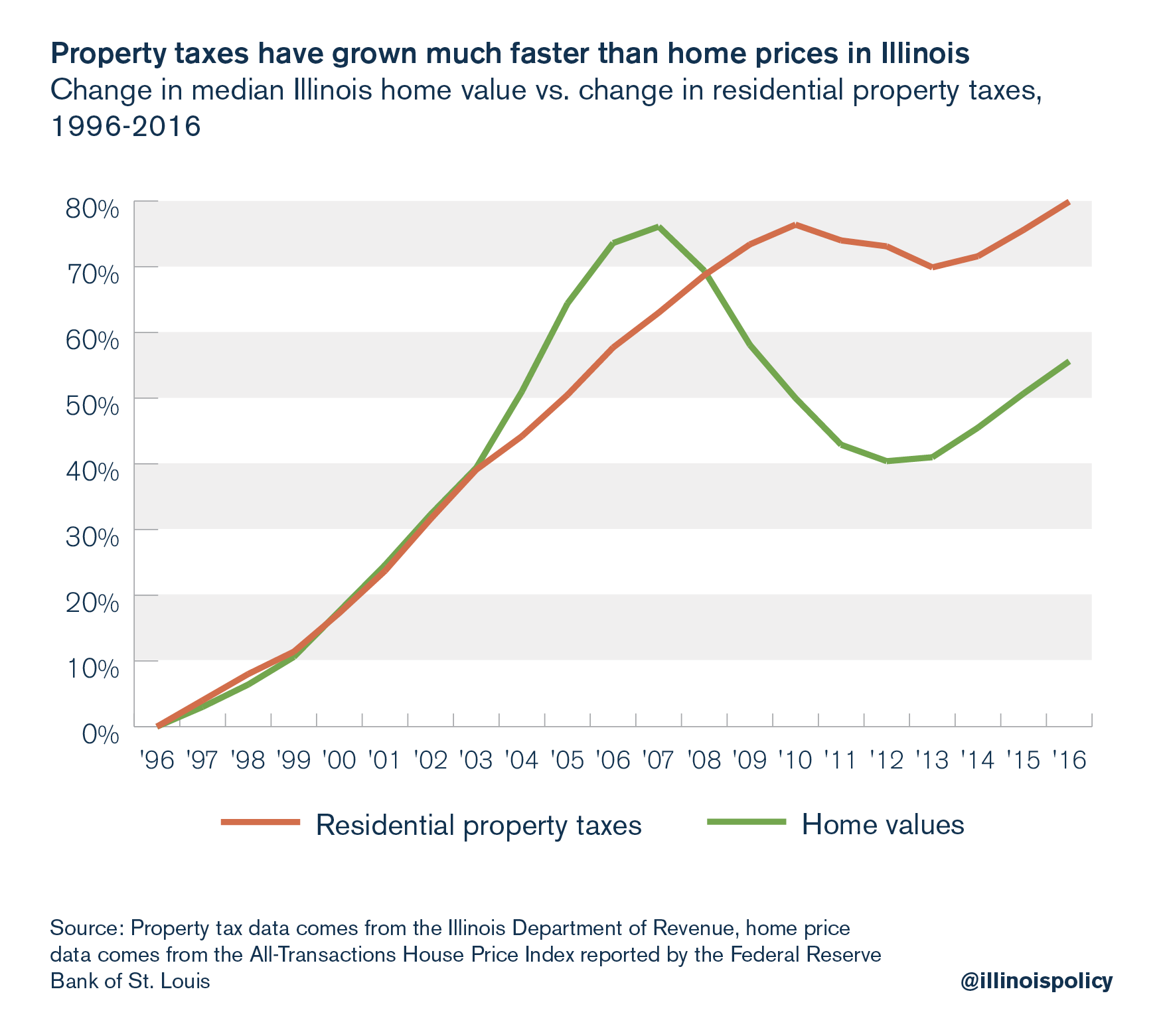

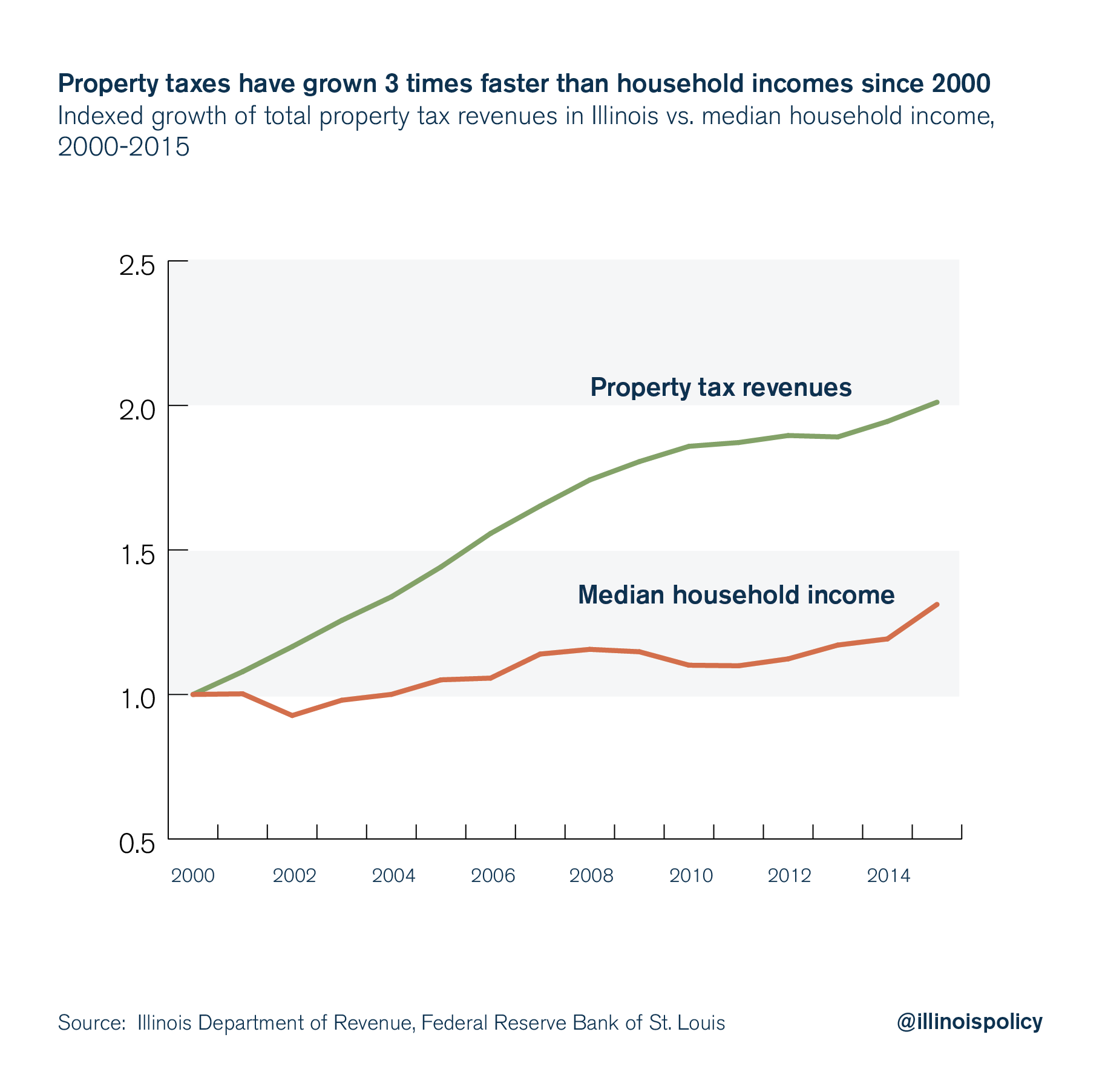

Property taxes grow faster than Illinoisans’ ability to pay for them, Under state law changes, in place through tax year 2025, the maximum amount of property taxes that can be deferred annually has been temporarily increased. A cook county treasurer’s report found that property taxes rose about $706 million, with homeowners paying an extra $611 million.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

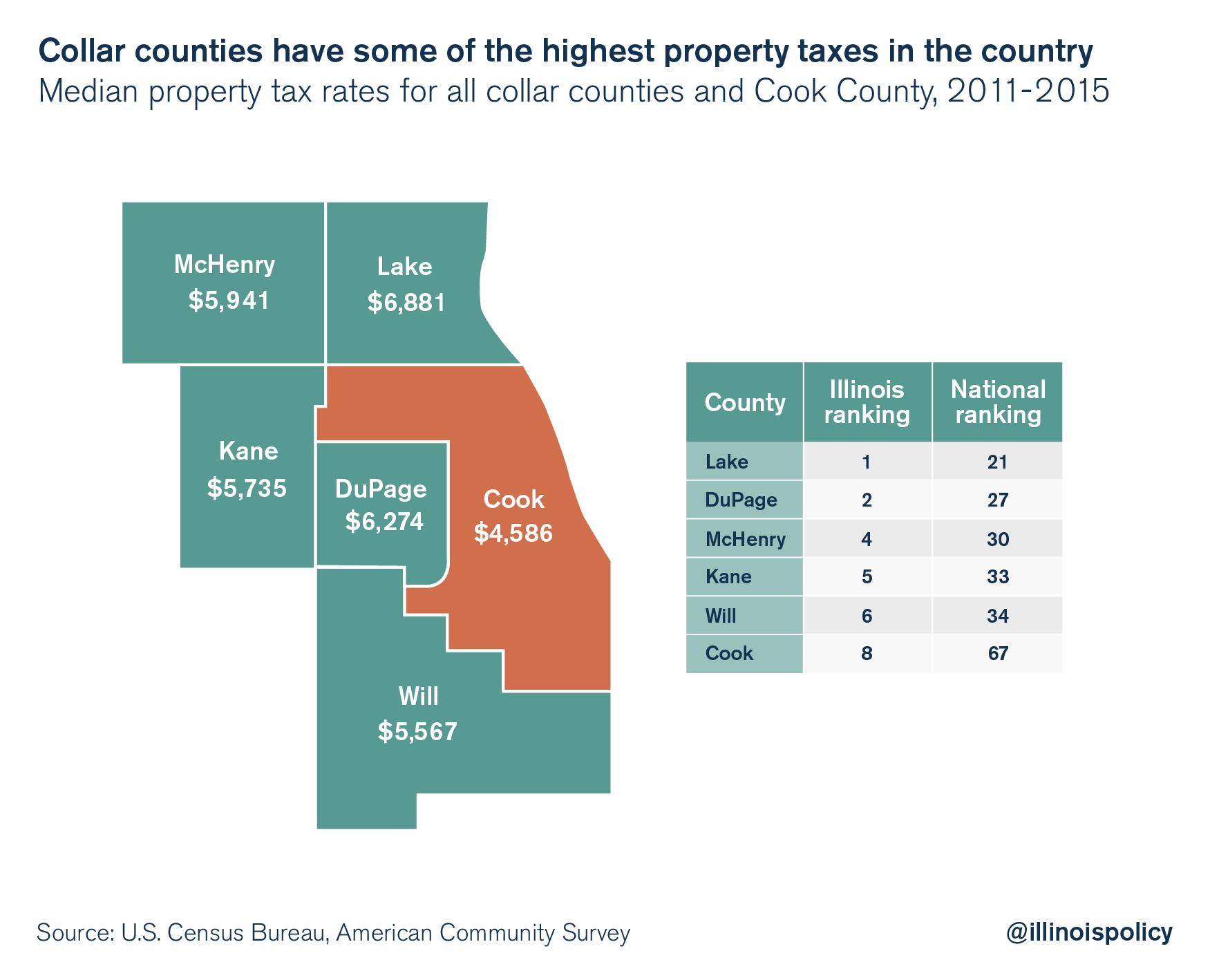

Homeowners in collar counties pay highest property taxes in Illinois, Last day to pay to avoid tax sale: The cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the elected officials who take.

Source: www.ctbaonline.org

Source: www.ctbaonline.org

UPDATED Illinois Property Taxes Center for Tax and Budget Accountability, The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value (the property's prior year's eav for which. Property tax bills are due aug.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

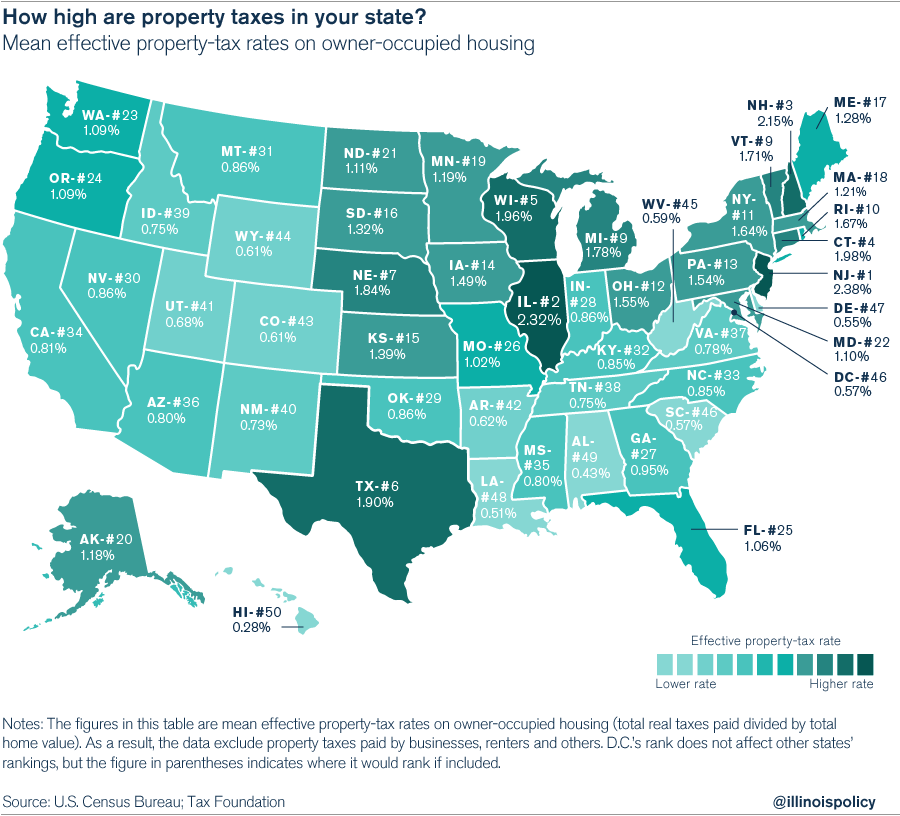

Illinois homeowners pay the secondhighest property taxes in the U.S., Please make sure the supervisor of assessments. View taxing district debt attributed to your property.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Homeowners in collar counties pay highest property taxes in Illinois, The illinois department of revenue does not administer property tax. The cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the elected officials who take.

Source: www.stcharlesil.gov

Source: www.stcharlesil.gov

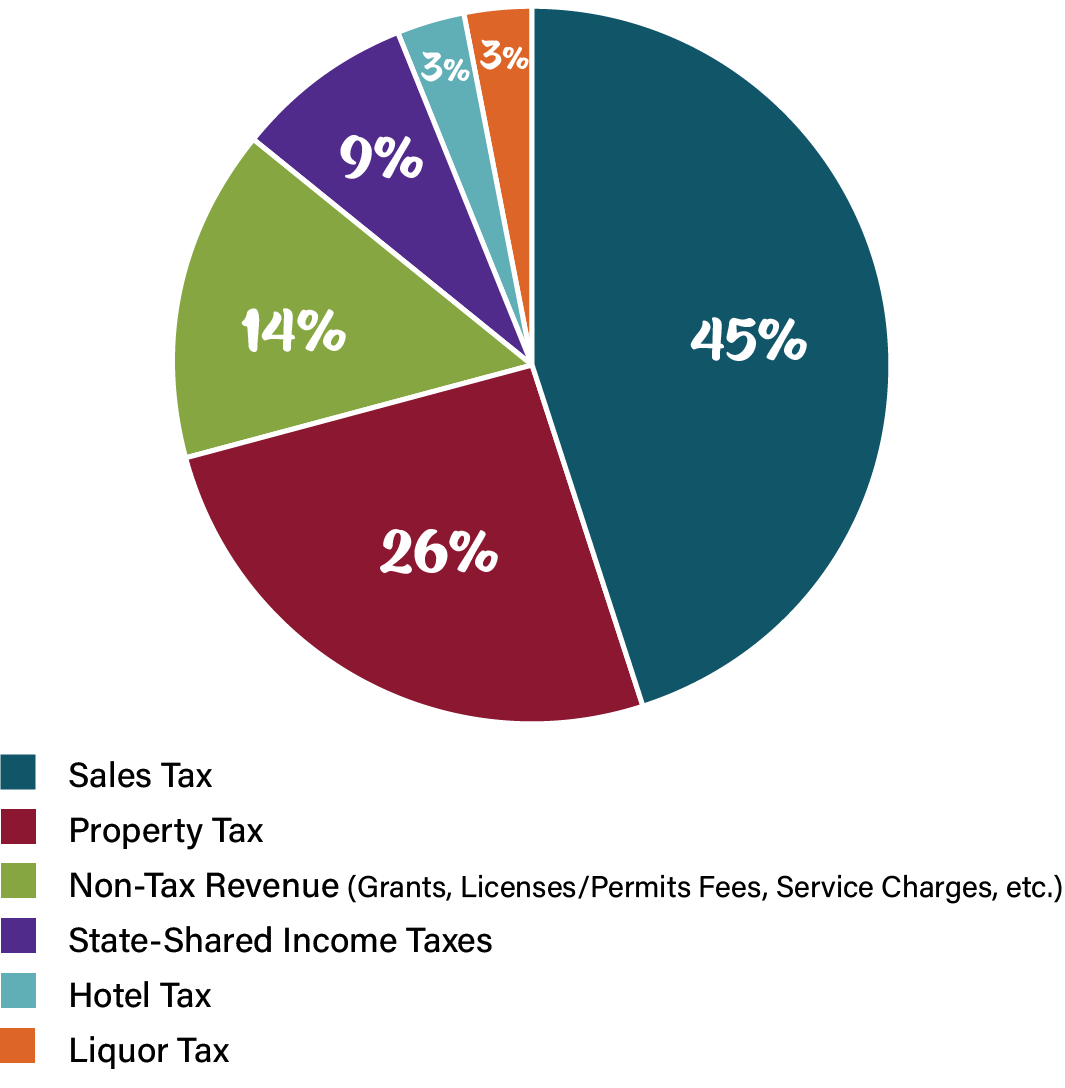

Property Taxes City of St Charles, IL, The cook county property tax portal is the result of collaboration among the elected officials who take part in the property tax system; Property tax bills are due aug.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

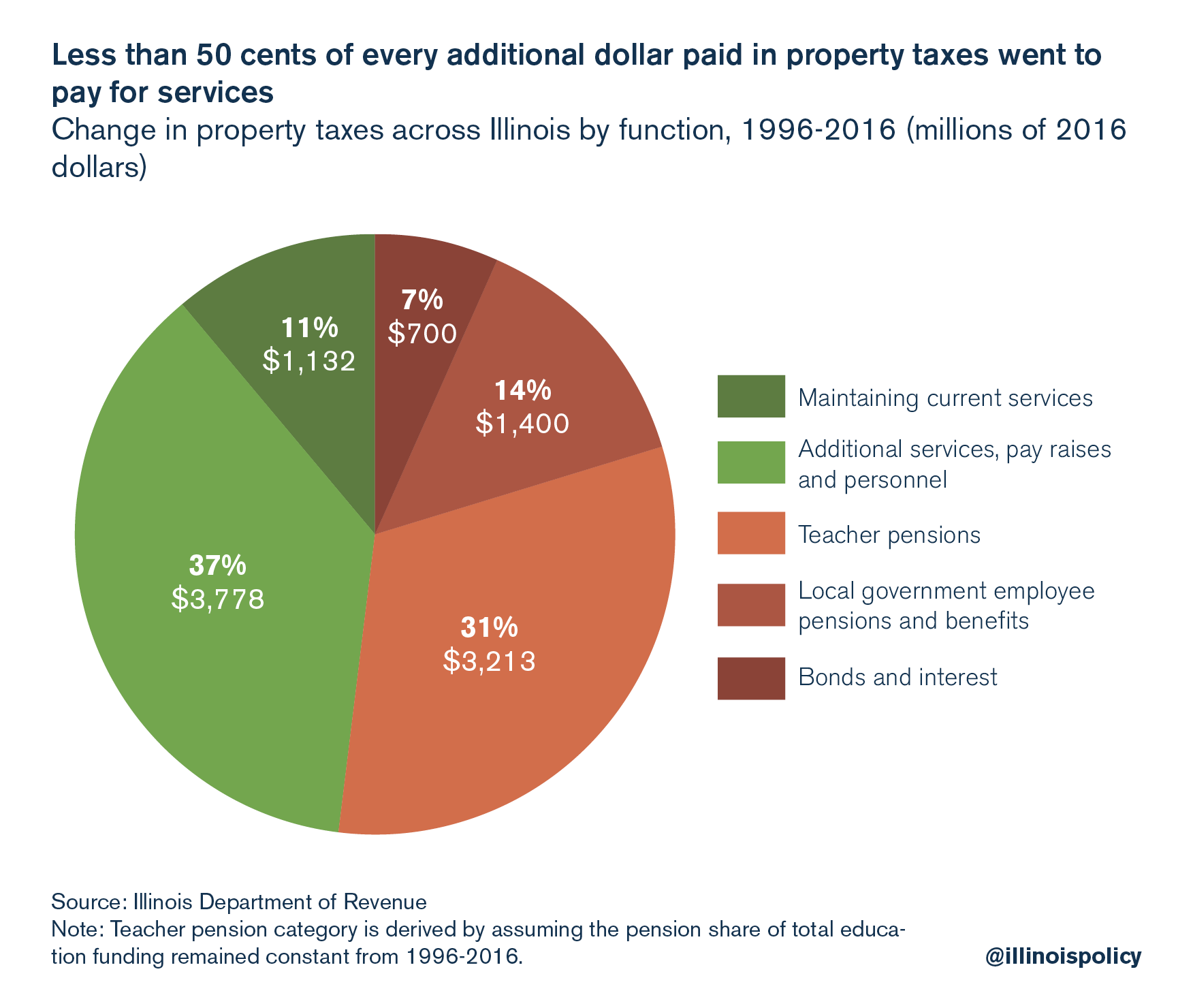

Pensions make Illinois property taxes among nation’s most painful, Add your email to receive important tax reminders. For example, there are different types of property taxes, the amount owed relies on.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Study Illinois property taxes still secondhighest in nation, See how your tax bill changed. 1.38% 2022 average home value:

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them, Please make sure the supervisor of assessments. Some make the total amount due on a single date, while others tell homeowners to pay their property taxes in installments throughout the year.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them, Tax year 2023 second installment property tax due date: Last day to pay to avoid tax sale:

Cook County Property Tax Officials Announced Today That Second Installment Property Tax Bills For Tax Year 2023 Will Be Available To Property Owners By July 2, 2024.

Please make sure the supervisor of assessments.

The Cook County Property Tax Portal, Created And Maintained By The Cook County Treasurer’s Office, Consolidates Information From The Elected Officials Who Take.

Today, officials from the cook county property tax system announced second installment property tax bills for tax year 2022 are expected to be available to property.

Category: 2025